By reading the ReputationUP guide, you will learn about financial compliance. Find out what it is, why regulation is essential, and the institutions’ requirements.

Index

Do you want to protect your financial reputation from any scandals?

ReputationUP protects your financial reputation from illegal operations and possible media scandals

What is financial compliance?

Financial compliance consists of the set of regulatory procedures, both internal and external, that a company must follow.

It is an obligation that, if inadequately managed, can lead to a crisis management.

Through compliance, companies prevent legal issues and economic sanctions.

The concept of compliance is becoming more and more relevant for companies.

The term was first used by the Basel Committee on Banking Supervision (BCBS) in 2005.

Through its document “Compliance and the compliance function in banks,” the body states that:

“The expression compliance risk is defined in this paper as the risk of legal or regulatory sanctions, material financial loss, or loss to reputation a bank may suffer as a result of its failure to comply with laws, regulations, rules, related self-regulatory organisation standards, and codes of conduct applicable to its banking activities.”

Why is financial compliance regulation essential?

Today financial compliance can also apply to companies.

Financial compliance rules are set for multiple reasons that can be traced back to the importance of assessing and managing risks:

- Legal security: it might be affected by data breaches that cyber criminals carry out;

- Earnings: negative management involves business income and, at the same time, customer acquisition;

- Online reputation: corporate brand image depends on regulatory compliance.

ReputationUP allows you to check how an entity stands regarding the reference countries’ code of ethics and regulations.

The company helps to calculate the risk index and the reputational value of this organisation.

Moreover, they allow certifying the Reputation Score through an advanced analysis and research platform that processes multilingual data in real-time.

Financial compliance for banks

Since 2008, the countries of the European Union have applied the legislative framework that refers to markets and financial instruments based on the MiFID II Directive and the MiFIR Regulation.

On the one hand, MiFID II is the Directive 2014/65/EU, referring to markets in financial instruments.

On the other hand, MiFIR is the EU Regulation No 600/2014, which refers to the financial market.

The new legislative framework aims, among other objectives, to improve transparency and investor protection.

The BCBS is the global institution responsible for the regulation of banks and financial institutions.

What are the compliance requirements for financial institutions?

The regulation of financial institutions is comprehensive, both at the global, European and national levels.

The Financial Services and Act 2021 makes amendments to the UK’s financial services regulatory framework after Brexit.

Do you want to check your partner’s financial reputation?

ReputationUP analyzes your partner’s financial reputation and sends you a detailed report

This act focuses on more top issues like:

- Prudential regulation of credit institutions and investment firms;

- Critical benchmarks;

- Access to financial services markets;

- Insider dealing and money laundering etc.

Financial institutions and financial intermediaries

As mentioned above, the BCBS is the international body responsible for the regulation of banks.

However, many financial intermediaries protect economic activity.

Financial globalization has led to the creation of the following institutions:

- International Monetary Fund (IMF);

- World Bank;

- International Chamber of Commerce (ICC);

- Organization for Economic Co-operation and Development (OECD).

Financial compliance for companies

Financial compliance came in response to major corporate financial and corruption scandals that occurred in the United States in the 1970s

The institutionalization of regulations causes companies to become more sensitive to financial compliance.

Indeed, businesses are mainly concerned about financial penalties and need to protect their financial reputation.

For this reason, it is vital to implement control tools such as codes of conduct, policies, or business ethics.

Another possible measure is to incorporate a specialized compliance team.

ReputationUP keeps track of the illegal operations of companies (money laundering, fraud, hiding of assets) and protects the financial reputation against any public scandal.

We find the final beneficiary of financial crimes and provide evidence to clients.

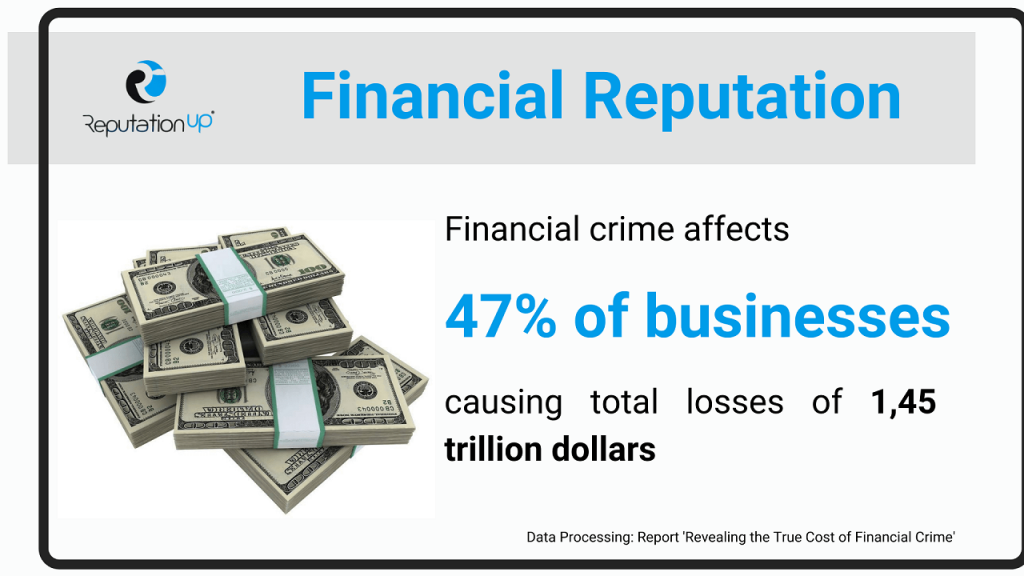

Financial crimes affect 47% of businesses that have suffered a total loss of $ 1.45 trillion.

Consequently, they need someone who protects them from reputational crises relating to infringements.

Financial compliance and financial reputation

Being aware of the link between financial compliance and financial reputation, ReputationUP operates precisely in this area.

Our team of experts works on behalf of individuals, companies, banks, and institutions.

We search for hidden assets and track people and movements that are likely related to fraud, money laundering, etc.

What are the examples of compliance risk?

For instance, the risk might depend on the breach of contract or corruption.

These obstacles affect a company‘s productivity and financial reputation.

However, companies can know in advance the ethical code of a potential business partner.

Do you want to check your partner’s financial reputation?

ReputationUP analyzes your partner’s financial reputation and sends you a detailed report

Reputation Score measures, on a scale from -100% to 100%, the reputation value and the risk index of an entity.

It provides accurate and certified information on twelve categories of related offenses:

- Terrorism;

- Terrorist financing;

- War crimes;

- Corruption;

- Financial crimes;

- Organized crime;

- Politically exposed persons;

- Drug trafficking;

- Smuggling;

- Counterfeiting;

- Sanctions;

- Money laundering.

What is Anti-Money Laundering?

Anti-Money Laundering (AML) and Know Your Customer (KYC) are closely intertwined.

AML is a fundamental procedure to prevent money laundering in transactions and contractual relationships.

World-Check database is the leading KYC Due diligence provider on financial entities and individuals facing high financial risk.

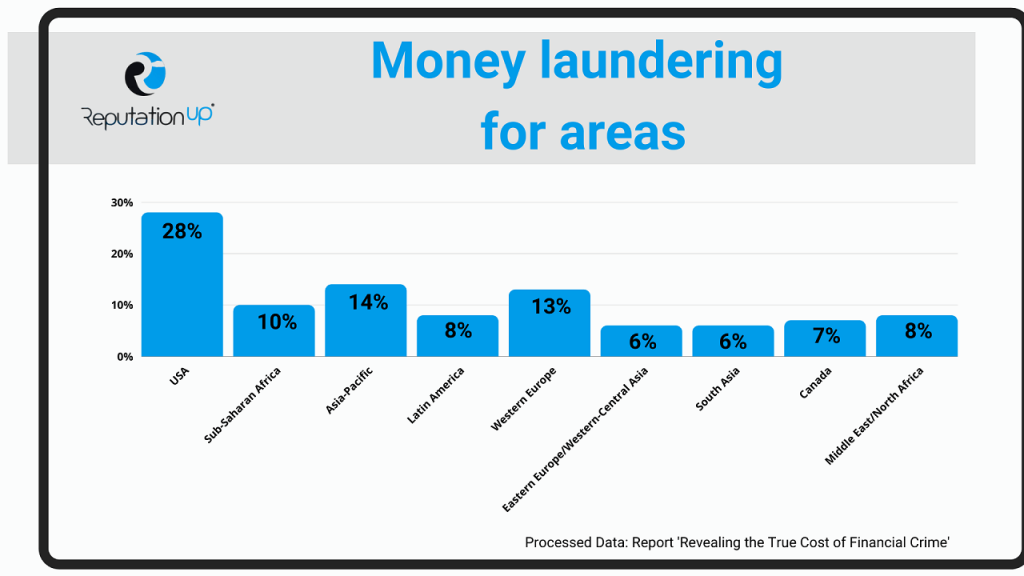

Globally, the United States (28%) and Asia Pacific (14%) are the two regions where money laundering has the most significant penetration, followed by Western Europe (13%) and Sub-Saharan Africa (10%).

To carry out a complete, quick and efficient investigation, you can contact ReputationUP.

Thus, you will know whether your company appears in the database used by financial and banking institutions.

Conclusions

Financial compliance is the set of regulatory procedures that companies must follow.

This concept is connected to legal security, business income, and reputation.

We may draw the following conclusions from this guide:

- BCBS was the first entity that used the term compliance;

- National, European and global regulations are updated to improve transparency and investor protection;

- BCBS is the body responsible for setting prudential regulation of banks;

- Compliance risk is associated with corruption, money laundering, etc;

- World-Check is the leading provider of financial risk services.

Our team of experts is responsible for protecting financial reputation by assessing the relationship between risk and reputational value.

Our advanced software checks if an entity operates in compliance with the code of ethics and regulations.